Join us to listen to Wil Chockley, Partner of 75 & Sunny speak about the company's investment thesis. The discussion will be focused on how Wil and his team analyze the most beneficial investment opportunities, in addition to how 75 & Sunny works with the companies it invests in to develop cutting-edge growth strategies and how to execute them effectively. Attendees will have the opportunity to take part in a question and answer session at the end of the webinar with Wil.

Investor 360: Monthly Investor Roundtable Interview

Featuring Wil Chockley of 75 & Sunny

Wednesday, July 21st, 2021

12:00 – 1:15 pm

An email containing the Zoom link for this event will be sent to attendees following registration.

About the Organizer of Investor 360

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

Register here for Investor 360: Monthly Investor Roundtable Interviews featuring Wil Chockley of 75 and Sunny.

Stubbs Alderton & Markiles, LLP (SA&M) represented client Nexient, a cloud-native company, in the negotiation of the definitive agreement pursuant to which the company has agreed to be sold to NTT Data, a global digital business and IT services leader.

Nexient is more than your average software development firm. Nexient provides cost-effective software development consulting and software development services from US-based innovation hubs in the Midwest and Silicon Valley. The ‘Onshore Outsourcing’ methodology promises to increase the flow of value seen with product development by using an Agile, projects to products (P2P) mindset. This fundamental shift from short-term projects to long-term product ownership ensures lasting value beyond development ideation, through execution and into operation.

To read more on Businesswire, click here.

Attorneys working on the transaction included Scott Alderton, Kelly Siobhan Laffey, Jonathan Hodes, Brent Armitage, Jared Brenner, Heather Antoine, Kevin DeBré, Daniel Garber, Saam Bagherzadeh, and Corporate Paralegal, Stephen Carroll.

About Stubbs Alderton & Markiles’ Mergers & Acquisitions Practice

The Firm’s Mergers & Acquisition Group advises clients in connection with a full range of mergers, acquisitions, dispositions, joint ventures and other strategic transactions, both public and private, domestic and international. At the commencement of a transaction, we bring our problem solving entrepreneurial spirit and unique practical experience to structure transactions, and to develop a due diligence process that focuses on the key value drivers for the business, including analyzing intellectual property rights and assets. The Firm’s experience and knowledge help ensure that you will successfully negotiate and close the most complicated transactions. Regardless of a company’s size or stage of development, we make our collective expertise, gained from handling a multitude of successful merger, acquisition and strategic transactions, available to each of our clients. The Firm prides itself on being able to devote significantly more high-level attention to our clients’ matters than other sophisticated law firms. Throughout the process, we work with management, keeping them fully informed and strategizing with them as developments arise. We pride ourselves on being highly responsive to our clients.

For more information on our Mergers & Acquisitions Practice, contact Scott Alderton at .

Stubbs Alderton & Markiles, LLP (SA&M) represented client Funny Or Die (FOD) in the sale of its branded content studio to Roku, and subsequently in the sale of the company to Henry R. Muñoz III, a prominent business leader and philanthropist.

Funny Or Die, an Emmy Award-winning leader in comedy entertainment, has expanded into a full-service video website and television production company that is now the number-one comedy brand across digital, social, and mobile channels.

The sale consists of the Funny Or Die content library, original production slate, and all social media assets that include over 40 million followers. LionTree served as the financial advisor throughout the duration of the deal, while SA&M worked with Funny Or Die as its legal advisor. The deal demonstrates the firm’s commitment to providing clients with top-tier transactional services in the entertainment and media industries.

Attorneys working on the transaction included Greg Akselrud, Madeleine Barenholtz and Brent Armitage.

The Internet, Digital Media & Entertainment Practice Group advises individuals and companies across all aspects of their corporate, strategic and licensing businesses, including in connection with a full range of mergers, acquisitions, dispositions, joint ventures and other strategic transactions. For more information about the Internet, Digital Media & Entertainment practice, contact Greg Akselrud at .

Stubbs Alderton & Markiles, LLP announced that its client UberMedia was recently acquired by Near. UberMedia aggregates mobile location data from a variety of sources into location insights and other products that guide strategic decisions for organizations of all sizes.

For the full article regarding Near's acquisition of UberMedia, click here.

SA&M Attorneys Advising Near in this transaction included:

Louis Wharton, Scott Alderton, Michael Shaff, Kelly Siobhan Laffey, Jared Brenner, Brent Armitage, and Daniel Garber.

About Stubbs Alderton & Markiles’ Mergers & Acquisitions Practice

The Firm’s Mergers & Acquisition Group advises clients in connection with a full range of mergers, acquisitions, dispositions, joint ventures and other strategic transactions, both public and private, domestic and international. At the commencement of a transaction, we bring our problem solving entrepreneurial spirit and unique practical experience to structure transactions, and to develop a due diligence process that focuses on the key value drivers for the business, including analyzing intellectual property rights and assets. The Firm’s experience and knowledge help ensure that you will successfully negotiate and close the most complicated transactions. Regardless of a company’s size or stage of development, we make our collective expertise, gained from handling a multitude of successful merger, acquisition and strategic transactions, available to each of our clients. The Firm prides itself on being able to devote significantly more high-level attention to our clients’ matters than other sophisticated law firms. Throughout the process, we work with management, keeping them fully informed and strategizing with them as developments arise. We pride ourselves on being highly responsive to our clients.

SA&M client Altius Sports Partners (“ASP”), a leading-edge name, image and likeness advisory and education firm, signed a new partnership with The University of Georgia. This partnership bring decades of expertise from ASP into the top echelon of collegiate athletics. ASP will build customized name, image and likeness programs for the athletic department, focusing on the strengths of the program. The program will include management of name, image and likeness rule changes, maximization of new opportunities, and helping the program achieve the highest standards of excellence for its staff, coaches, and student athletes, from education and recruiting to administration and fundraising.

To read the full news mentions on SA&M Client ASP's New Partnership, see Sports Business Journal - Altius Sports to help UGA with NIL education

About Altius Sports Partners ("ASP")

Through consulting, strategic planning, compliance support and education, we support all stakeholders – athletic departments, coaches and student-athletes – with the resources they need to thrive in this new age of college athletics. ASP uses a 3-phased approach for the needs of colleges and universities as NIL rules develop. The phases include: (1) engagement and preparation through critical analyses of school-specific NIL threats and opportunities as well as educational plans for coaches and staff; (2) building a comprehensive educational program for student-athletes that will help them navigate the rapidly evolving NIL landscape; and (3) ongoing oversight of the NIL program through the use of technology to educate and guide student-athletes, as well as continued strategic guidance at the institutional level.

About Stubbs, Alderton & Markiles

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

For more information about our Internet, Digital Media & Entertainment practice, contact Greg Akselrud at

Join us to listen to Vaughn Blake of Blue Bear Capital speak about the Blue Bear's investment thesis, current investment climate, startup advice and more. Company founders will have the opportunity to ask the investor questions at the end of the webinar.

Investor 360: Monthly Investor Roundtable Interview

Featuring Vaughn Blake of Blue Bear Capital

Wednesday, April 21, 2021

12:00 - 1:15 pm

About Vaughn Blake

About Vaughn BlakeVaughn Blake is a partner at Blue Bear Capital, a venture and growth equity firm focused on data-driven solutions across energy, infrastructure and climate. Prior to joining Blue Bear, he led manager selection across venture and hedge fund strategies for a Southern California family office and was the founder and managing director of Autochrome Ventures, a frontier-technology focused venture fund. He holds board positions at Emerge, Transect, Mira and First Resonance. He is a graduate of Colorado College.

Blue Bear is backed by private equity investors, entrepreneurs and technical operators who have spent their careers in the energy and technology industries. We are committed to helping entrepreneurs execute on this historic opportunity.

About the Organizer of Investor 360

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

Register here for Investor 360: Monthly Investor Roundtable Interviews featuring Vaughn Blake of Blue Bear Capital

SA&M client Altius Sports Partners (“ASP”), a leading-edge name, image and likeness advisory and education firm, signed a new partnership with The University of South Carolina. This partnership bring decades of expertise from ASP into the top echelon of collegiate athletics. ASP will build customized name, image and likeness programs for the athletic department, focusing on the strengths of the program. The program will include management of name, image and likeness rule changes, maximization of new opportunities, and helping the program achieve the highest standards of excellence for its staff, coaches, and student athletes, from education and recruiting to administration and fundraising.

To read the full news mentions on SA&M Client ASP's New Partnership, see

About Altius Sports Partners ("ASP")

Through consulting, strategic planning, compliance support and education, we support all stakeholders – athletic departments, coaches and student-athletes – with the resources they need to thrive in this new age of college athletics. ASP uses a 3-phased approach for the needs of colleges and universities as NIL rules develop. The phases include: (1) engagement and preparation through critical analyses of school-specific NIL threats and opportunities as well as educational plans for coaches and staff; (2) building a comprehensive educational program for student-athletes that will help them navigate the rapidly evolving NIL landscape; and (3) ongoing oversight of the NIL program through the use of technology to educate and guide student-athletes, as well as continued strategic guidance at the institutional level.

For more information about our Internet, Digital Media & Entertainment practice, contact Greg Akselrud at

Join us to listen to Joshua Posamentier of Congruent Ventures speak about the Congruent's investment thesis, current investment climate, startup advice and more. Company founders will have the opportunity to ask the investor questions at the end of the webinar.

Investor 360: Monthly Investor Roundtable Interview

Featuring Joshua Posamentier of Congruent Ventures

Wednesday, March 17th, 2021

12:00 - 1:15 pm

Joshua Posamentier is Co-Founder and Managing Partner of Congruent Ventures. Joshua oversees Congruent’s investments in PolySpectra, Sense Photonics, Energetic Insurance, TeleSense, Bellwether Coffee, Xtelligent, ArcByt, Fox Robotics, and Emergy Labs. He has rich experience in venture (Prelude Ventures, Intel Capital) and operating roles (Intel, National Semi, TI), and entrepreneurship (CEO of Blipstream). He was an integral member of Intel’s first wireless chip team, started and ran National Semiconductor’s EV, Energy Storage and Smart Grid business units and initiated investment in several new business lines. Joshua has over 50 patents issued or pending, holds a BA in physics from the University California at Berkeley, and holds MBAs from the Columbia Business School and the Haas School of Business. Josh is an avid cyclist, skier, sailor, surfer, and photographer and lives with his family in the SF Bay Area.

Congruent Ventures partners with entrepreneurs to build companies addressing sustainability challenges, investing early across hardware, software, enterprise, consumer, deep technology, fin-tech, and business model innovation.

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

Register here for Investor 360: Monthly Investor Roundtable Interviews featuring Joshua Posamentier of Congruent Ventures

The Preccelerator® Program Virtual Demo Day kicks off on March 25th @ 3:30 pm, and you're invited to take part in the festivities.

Preccelerator cohort companies are early stage, and we work hand in hand with them throughout their term to know their market and users, foster their leadership skills, build and test their product, avoid legal pitfalls, ensure the defensibility of their products, acquire users and partnerships and prepare them for the fundraising process. Now it's time to showcase their efforts.

Preccelerator® Program Virtual Demo Day

March 25th, 2021 @ 3:30 PM

Bevz also provides professional services like event planning, bartending, and alcohol catering to make your next event a success! With only a few taps, a Bevz team member will help you set up a professional bar at your venue of choice, taking you from planning-mode to partying-mode!

Bevz is a one-stop shop delivered to your door in 45 minutes or less. Download the Bevz app to make your next big event – or cozy night in – simple, easy, and fast!

Visit https://bevz.com/

BlockForms is a platform built for Employee Benefit Insurance Brokers to transform the process of managing multiple insurance provider applications for their clients. BlockForms delivers an intuitive, reliable product that improves client engagement and employee performance by streamlining data collection and forms management. The encrypted, cloud-based application allows service teams to invite clients to complete simplified forms, automatically map responses to multiple insurance provider forms, edit forms, obtain electronic signatures, and send fully executed forms to insurance providers in one secure application. Simply put, BlockForms makes it fast and easy to sign-up customers, collect client data, and apply for coverage across multiple insurance providers.

Visit https://blockforms.co/

Breakthru microbreaks are restorative and self-paced, yet fast, flexible, and on-demand. They help people context shift, focus, and create, replacing former office rituals like midday walks to combat sedentary behavior. It’s proven that small moments of movement throughout the day have measurable well-being impact. Breakthru is a solution that has been in development for three years, with 2.5 million of research dollars coming from strategic partners. Its roll out is designed as not just an individual betterment tool but focused on the well-being of the group. At its core is the belief that people adopt healthier habits and thrive with support and accountability to a community. To encourage remote collaboration, Breakthru is designed to be shared in a meeting or given as a gift by a friend, colleague, or trusted leader within an organization. People take better care of themselves when they take care of each other, and we’re proud that we have a product that is useful to enterprise and employees today, as they navigate a new work landscape.

Backstage Capital

About the Preccelerator

The Preccelerator® Program is an accelerator for early-stage startups offered to select companies out of the Santa Monica office of Stubbs Alderton & Markiles, LLP that provides initial capital, sophisticated legal services, interim office space, mentorship, a targeted curriculum, investment strategy counseling and access to a strategic perks portfolio with the objective of helping you grow your idea from business concept to funded startup. The Preccelerator® provides these benefits to as many as 5 promising young startups per term. Visit www.preccelerator.com

Stubbs Alderton & Markiles attorneys Garett Hill and Kelly Siobhan Laffey have been featured in the National Law Review with their article "New Stimulus Expands the Employee Retention Tax Credit."

On December 27, 2020, President Trump signed the Consolidated Appropriations Act into law, which includes various forms of COVID-19 relief (the “New Stimulus Act”). Specifically, the New Stimulus Act includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020, effective January 1, 2021, which, among other things, amends and extends the employee retention tax credit (ERTC) and the availability of advance payments of the tax credits under the CARES Act. This article will revisit the ERTC under the CARES Act and highlight the differences of the ERTC as amended and extended by the New Stimulus Act.

To read the full article, "New Stimulus Expands the Employee Retention Tax Credit" in the National Law Review, click here.

SA&M Attorneys Published in the National Law Review

Since joining SA&M, Garett has made significant contributions to a wide variety of litigation matters. Specifically, Garett has assisted in the successful resolutions of complex commercial arbitrations, partnership disputes, judicial dissolution actions, and breach of contract and fiduciary duty claims. Additionally, he has provided invaluable insight and advice to clients in developing areas of law, including proper worker classification and government relief programs made available to businesses during the COVID-19 pandemic.

Kelly Siobhan Laffey is Senior Counsel at Stubbs Alderton & Markiles, LLP and the Director of Business Affairs at the SA&M Preccelerator.

Kelly’s practice focuses on advising emerging growth and middle market companies in the technology, digital, internet, interactive media (i.e., AR and VR), and entertainment industries. Kelly Laffey counsels clients on issues related to corporate governance and formation, venture capital and other financings, joint ventures, employee compensation, complex stockholder and operating agreements, securities law regulation and other general corporate matters. Kelly also advises investors and funds in connection with venture capital and other financings.

Kelly also counsels clients in connection with mergers and acquisitions matters, including asset and equity acquisitions and dispositions, cross-border transactions, spin-off transactions, secured lending transactions, financing restructurings and corporate reorganizations. Drawing on her diverse work experience in the entertainment arena, including time spent with talent agencies, and music and television production companies, Kelly also assists on matters related to licensing, marketing, and exploitation of intellectual property rights.

To learn more about the employee retention tax credit, contact Kelly Siobhan Laffey at .

January 6, 2021 – LOS ANGELES, CA. Stubbs Alderton & Markiles client, Steril-Aire, a leading innovator of high energy germicidal ultraviolet C (UVC) solutions has announced its acquisition by Madison Industries, one of the world’s largest privately held companies and leading provider of comprehensive indoor air hygiene solutions. This acquisition makes Madison Industries one of the only companies in the market with a complete portfolio of science-backed indoor air hygiene solutions.

Attorneys representing Steril-Aire in this transaction include Jonathan Hodes, Madeleine Barenholtz, and Daniel Garber.

About Steril-Aire

Steril-Aire is a leading innovator of high energy germicidal UVC solutions. Its decades of science based and technology backed solutions create a better and safer environment to live, work and breathe. Steril-Aire’s science is groundbreaking in enhancing the indoor air quality of customer working environments. Steril-Aire’s solutions can be found in hospitals, schools, nursing homes, airports, laboratories, government facilities, offices and food safety.

About Madison Industries

Madison Industries is one of the largest and most successful privately held companies in the world. Madison builds entrepreneurially driven, branded market leaders that are committed to making the world safer, healthier and more productive by creating innovative solutions that deliver outstanding customer value. The team at Madison is committed to building something truly remarkable that long outlasts them while coaching others to reach their highest potential.

For more information about our Mergers & Acquisitions practice, contact Jonathan Hodes at or (818) 444-4508.

January 5, 2021 – LOS ANGELES, CA. Stubbs Alderton & Markiles announced today that it represented client, Venice Pacific Investments, LP, over a two-year period in a $162M transaction for the sale of its properties located at 8771 Washington Boulevard, 8876-8888 Venice Boulevard, 8825 National Boulevard and 8829 and 8833 National Boulevard.

SA&M attorneys representing Venice Pacific Investments in the sale transaction included Jonathan Hodes, Michael Shaff, with assistance from Stubbs Alderton & Markiles paralegal Cynthia Otero.

Jonathan Hodes: Jonathan Hodes specializes in buy side and sell side domestic and international mergers and acquisitions, management buy-outs, leveraged buy-outs, leveraged recaps, mezzanine and senior debt financing transactions, work-outs and secured lending and leasing transactions.

Jonathan’s focus emphasizes M&A activity in the middle market and also includes representation of emerging growth companies from inception through various tiers of venture capital and growth financing often with the goal of an exit through a sale, merger, IPO or other corporate finance transaction. He devotes significant time to private equity deals with an emphasis on add on portfolio acquisitions to existing platforms, and dispositions of portfolio companies.

Michael Shaff: Michael Shaff specializes in all aspects of federal income taxation. Mr. Shaff has served as a trial attorney with the Office of the Chief Counsel of the Internal Revenue Service for three years. Mr. Shaff is certified by the Board of Legal Specialization of the State Bar of California as a specialist in tax law. Mr. Shaff is a past Chair of the Tax Section of the Orange County Bar Association. He is co-author of the “Real Estate Investment Trusts Handbook” published annually by West Group.

The Stubbs Alderton & Markiles' Mergers & Acquisition Group advises clients in connection with a full range of mergers, acquisitions, dispositions, joint ventures and other strategic transactions, both public and private, domestic and international. For more information about the Mergers & Acquisitions practice at SA&M, please contact M&A Practice Co-Chair Jonathan Hodes at jhodes@stubbsalderton or (818) 444-4508.

Join us to listen to Mike Shapiro of Major League Baseball speak about the MLB's investment thesis, current investment climate, startup advice and more. Company founders will have the opportunity to ask the investor questions at the end of the webinar.

Investor 360: Monthly Investor Roundtable Interview

Featuring Mike Shapiro of Major League Baseball

Wednesday, January 20th, 2021

12:00 - 1:15 pm

About Mike Shapiro

About Mike ShapiroMike Shapiro is the Director of Innovation and Venture Investing at Major League Baseball. His role at MLB includes sourcing and executing on venture investments in business across a number of strategic areas including broadcast technologies, data analytics, marketing technology and ticketing. In addition, Mike looks to identify innovative businesses for MLB's 30 ball clubs to work with across areas such as player performance, in-stadium hospitality and fan engagement. Mike received a B.S. in Finance and M.A. in International Business from the University of Florida. He also received an MBA from Columbia Business School.

About the Organizer of Investor 360

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

Register here for Investor 360: Monthly Investor Roundtable Interviews featuring Mike Shapiro of Major League Baseball

During this event, we will discuss what happens before, during, and after a data breach.

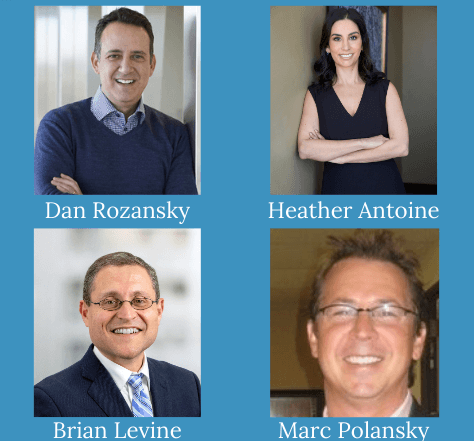

Partner, Stubbs, Alderton & Markiles, LLP

Clients engage Dan before disputes ever arise to advise on strategies to minimize litigation risk and to put clients in a position for a successful outcome if litigation does arise. For example, he regularly reviews television pilots, screenplays and other material in development to assist those clients in identifying and avoiding potential liabilities; he advises clients, including Fortune 100 companies, on best practices for recording communications; he counsels clients on best practices to protect trade secrets and other confidential information; and he guides clients contemplating exiting unfavorable business relationships. When disputes arise, Dan Rozansky brings his decades of experience at AmLaw 100 and 200 firms and his relentless approach help achieve the best possible outcome for his clients. This approach has led Dan to be recognized as an industry leader, including being listed as a top entertainment and media litigator in Chambers USA (2011-2019). In 2013, 2014, and 2016, he was featured in Variety’s “Legal Impact Report,” which names the top attorneys who are making a significant impact in the entertainment industry.

Partner, Stubbs Alderton & Markiles, LLP

Chair of the Trademark & Brand Protection Practice, & Co-Chair of the Privacy & Data Security Practice

Heather A. Antoine is a Partner and Chair of the Firm’s Trademark & Brand Protection practice group and Co-Chair of the Privacy & Data Security practice group.

Heather is focused on guiding businesses through the ever-expanding maze of privacy laws, both domestically and internationally. This includes compliance with specific privacy laws such as the California Consumer Privacy Act, the General Data Protection Regulation, and the Children’s Online Privacy and Protection Act. Heather works with companies to design and strengthen their privacy and data security policies and practices, to help prevent data breaches, and to minimize the risks associated therein.

Heather’s practice also focuses on protecting a company’s intellectual property; a fundamental feature of every business. Heather’s practice includes trademark clearance and selection, domestic and foreign trademark prosecution, enforcement, proceedings before the Trademark Trial and Appeal Board (TTAB), licensing, trade secret protection, copyright, rights of publicity, domain names disputes, and general client counseling. Heather supports companies at each stage – from due diligence when choosing a name, to ongoing brand management, to ensuring portfolios are safeguarded and ready for growth and sale.

Heather serves as Chair of the California Lawyers Association Intellectual Property Section. Heather frequently speaks and writes about IP, Internet, tech, and privacy issues. She has been quoted in publications such as the Los Angeles Times and CNBC. Heather has been recognized by her peers for excellence in her practice, having been selected as Southern California Super Lawyers Rising Star® multiple times.

Managing Director, Ernst & Young Parthenon’s Strategy and Transactions Group

Brian is a Managing Director in EY Parthenon’s Strategy and Transactions Group. At EY Parthenon, Brian leads a team of 30 experts in cybersecurity and data privacy, focused on the strategic application of cybersecurity and data privacy in the context of capital transactions, including mergers, acquisitions, divestitures, real estate transactions and restructurings. In that capacity he works with clients to assess their cybersecurity and data privacy compliance, build and improve cybersecurity and compliance programs, prepare for and prevent breaches, and respond to security incidents.

Brian joined EY Parthenon from the U.S. Department of Justice (DOJ), where he served for five years as the National Coordinator for more than 300 federal prosecutors focused on investigating and prosecuting computer crime and intellectual property crime. Brian also served for seven years as a federal prosecutor and senior counsel with the DOJ’s Computer Crime and Intellectual Property Section. While with the DOJ, Brian conducted the first U.S. criminal trial against a PRC-entity for trade secret theft, resulting in conviction on all counts. Brian also investigated and prosecuted a Romanian organized crime group for developing their own malware, infecting more than 400,000 computers worldwide, and stealing millions of dollars, resulting in conviction at trial and 20 year sentences.

Prior to joining the DOJ, Brian served as an Assistant Attorney General for the Internet & Technology Bureau of the New York Attorney General’s Office, a civil litigator for international law firms, and a law clerk to federal district and appellate judges. Brian earned his BA, summa cum laude, from the University of Pennsylvania and his JD, magna cum laude, from New York University School of Law. He is a certified privacy professional and the recipient of numerous awards, including two Attorney General’s John Marshall Awards.

Chief Legal Officer, Seed Beauty

Marc Polansky is the Chief Legal Officer for a vertically integrated color cosmetic manufacturer, Seed Beauty, LLC and its Affiliates. Prior to joining Seed, Marc Served as General Counsel for software and technology companies and was also a trial attorney and partner at national and international law firms including, Cozen O’Connor, Lewis Brisbois Bisgaard & Smith and Grotefeld Hoffmann. Marc has broad array of litigation experience covering business matters, insurance coverage, catastrophic personal injury, and large property losses including utility caused wildfires.

Join us to listen to Michael Tam of Craft Ventures speak about Craft's investment thesis, current investment climate, startup advice and more. Company founders will have the opportunity to ask the investor questions at the end of the webinar.

Investor 360: Monthly Investor Roundtable Interview

Featuring Michael Tam of Craft Ventures

Wednesday, November 18th, 2020

12:00 - 1:15 pm

About Michael Tam

About Michael TamMichael is a principal at Craft on the investment team, based in Los Angeles. Prior to joining Craft, he was an investor at Crosscut, where he led investments and participated on the boards of consumer and enterprise companies. As an operator, Michael managed Uber's business in Southern California markets and launched L., a direct to consumer brand acquired by Procter & Gamble. Michael began his career in venture at Bullpen Capital. Previously, he worked at BofA Merrill Lynch's tech investment banking group and began his career at PwC.

Michael serves on the investment committee of the USC Marshall Fund, which invests in startups in the Southern California tech ecosystem.

Building great companies is a craft that takes skill, tenacity and focus. The craft of entrepreneurship provides the namesake for their firm.

The partners at Craft have all built successful companies as former Founder/CEOs. They know that the entrepreneurial journey is a long and arduous one, because they have lived it themselves. This gives them a deep respect for founders and genuine empathy for their inevitable ups and downs.

Before founding Craft, they also participated in many other entrepreneurial journeys as angel investors. They invested in some of our generation’s most iconic companies including Affirm, Airbnb, Eventbrite, Facebook, Houzz, Slack, SpaceX, Tesla, Trulia, Twilio, Twitter, Uber, and Warby Parker.

About the Organizer of Investor 360

Stubbs Alderton & Markiles, LLP is a business law firm with robust corporate, public securities, mergers and acquisitions, entertainment, intellectual property, brand protection and business litigation practice groups focusing on the representation of, among others, venture backed emerging growth companies, middle market public companies, large technology companies, entertainment and digital media companies, investors, venture capital funds, investment bankers and underwriters. The firm’s clients represent the full spectrum of Southern California business with a concentration in the technology, entertainment, videogame, apparel and medical device sectors. Our mission is to provide technically excellent legal services in a consistent, highly-responsive and service-oriented manner with an entrepreneurial and practical business perspective. These principles are the hallmarks of our Firm.

Register here for Investor 360: Monthly Investor Roundtable Interviews featuring Michael Tam of Craft Ventures

Each month, we will feature a Stubbs Alderton & Markiles, LLP practice area to aid our readers in getting to know our firm, and providing insights into these areas of law that may impact your business most often. This month, we put the Spotlight on the Privacy & Data Security Practice team.

I began my journey into privacy and data security law accidentally, when it was still a burgeoning, undefined field. A client inquired as to whether I could provide guidance on privacy issues his company was facing. I hesitated, but he pressed on, commenting, “no one knows what they are doing in this field yet, I’d rather have you learn it.” The skills I used then are the same I use now. These laws are constantly evolving and the ability to learn, and interpret, a new law quickly is both invaluable and essential. This is also what keeps me engaged. The practice of privacy and data security law requires adaptability and creativity. Every business operates differently and requires advice that suits their needs; there is no cookie cutter approach to this practice.

I became a privacy and data security attorney by accident. I was part of the legal team that took Geocities public in 1998. Geocities was a Web 1.0 precursor to today’s social media companies. Two days after its IPO, Geocities was sued by the FTC alleging that Geocities violated its privacy policy and misled consumers by sharing their personal information with advertisers. The company’s share price dropped 15%. It was the first FTC case involving Internet privacy and my first exposure to what would become a new body of law.

I view information and data as a fifth form of intellectual property (the others being patents, copyrights, trademarks and trade secrets). Whether it’s preparing a privacy policy for a website or app, negotiating privacy and data security representations and warranties for the seller in M&A transaction or advising a client on notifying customers of a security breach, privacy and data security has become a critical component of my practice. And, its importance will continue to grow.

I think for me, my interest in privacy and data security was spurred by my interest in technology and the impact it has had in areas like business and communications. In college I studied finance and information systems and after college, I took a job in the technology risk management group of a large global bank. I was responsible for conducting various risk assessments on new applications. It was interesting to be there at a time when the bank was moving toward developing a significantly larger mobile app portfolio. As such, there was a strong emphasis on security and privacy issues. Over the course of my time at the bank, I became more closely involved in regulatory issues that impacted the bank's technology and risk department. I enjoyed the subject matter so much I decided to go to law school and become a technology attorney.

I started my career in Europe working on transatlantic issues. Right around the time I moved back to the United States, the General Data Protection Regulation (GDPR) in Europe was passed, which affected numerous US companies. Because of my transatlantic experience, my practice naturally gravitated to the GDPR and global privacy and technology. I ultimately decided to stay in privacy and technology because it is exciting to be a part of an industry with so much innovation that affects our daily lives on a global scale.

The difference is an important one because although they intersect, privacy and data security do not overlap completely.

Privacy is generally viewed as protecting individuals' personal information and the rights individuals have over that information. Privacy laws concern how data is collected, shared, and stored. Privacy laws are typically highly regulatory in nature and include regimes such as the California Consumer Privacy Act, the Health Insurance Portability and Accountability Act, the General Data Protection Regulation (EU/EEA), and the Personal Information Protection and Electronic Documents Act (Canada), to name a small few. These laws create a patchwork of overlapping and sometimes contradictory rules for companies to follow.

Data security is generally viewed as a broader term that relates to safeguarding the confidentiality, integrity and availability of information. Data security applies to more than just personal information - it applies to any data that a company may hold, particularly sensitive information like trade secrets or material nonpublic information. Data security standards are often less formally regulated and can vary from industry to industry and state to state. However, in the event of a data breach, the severity of damages, fines, and other remediation measures may be dependent on the data security standards implemented at your business.

One of the most important things about a privacy policy is that it accurately describes your company's practices with respect to the collection, handling and disclosure of personal information. The policy needs to be drafted to not only comply with laws such as the California Consumer Privacy Act, and General Data Protection Regulation, but also be tailored to your company's specific practices. A lawyer can help to ensure your privacy policy does both of these things.

Moreover, we have seen an increased focus on privacy issues over the past decade, which will only grow in the future. There is a real risk when it comes to privacy policies. The first place regulators will often look to evaluate your privacy compliance is your website. Regulators have opened investigations and fined companies for failing to accurately describe the company’s handling of personal information and consumers have filed claims, including class action suits, when companies fail to handle personal information in the manner described in a privacy policy. That said, your privacy policy is just the start. Privacy must be embedded into the company’s IT, marketing practices, and security. Otherwise, it is just window dressing.

This is a tough question to answer as cyber incidents or breaches come in many forms. The most important steps should be taken even before an incident occurs. Company's should be thinking about developing an incident response plan and creating an incident response team – the team may include members from the IT, operations, HR and communications functions as well as a digital forensics team and outside counsel. The company should also test the incident response plan so that when an incident occurs, it is set up to respond quickly and efficiently.

If a company has experienced a breach, one of the first steps is to assemble of team to respond to the incident. For various reasons, this team should include outside counsel. The next steps after that can vary and may require a few different workstreams, including forensics, remediation, developing and updating a communications plan, and assessing legal obligations and notification requirements. In the event of a suspected breach, please do not delay in taking action.

For more information about our Privacy & Data Security practice at Stubbs Alderton & Markiles, contact Heather Antoine at or Kevin Debré at

SA&M client Altius Sports Partners (“ASP”), a leading-edge name, image and likeness advisory and education firm, signed two new partnerships with Louisiana State University and The University of Texas. These partnerships bring decades of expertise from ASP into the top echelon of collegiate athletics. ASP will build customized name, image and likeness programs for each athletic department, focusing on the strengths of each program. ASP is also finalizing a partnership deal with Arizona State University Athletics. The programs will include management of name, image and likeness rule changes, maximization of new opportunities, and helping each program achieve the highest standards of excellence for its staff, coaches, and student athletes, from education and recruiting to administration and fundraising.

To read the full press release, click here.

To read the ASP Sports Business Journal Article, click here.

Greg Akselrud advises clients across a wide range of industries, including companies in the sports, entertainment, digital media, Internet, technology, software, mobile, and venture capital industries. For more information about our Internet, Digital Media & Entertainment practice, contact Greg at

Stubbs Alderton & Markiles, LLP announced that it represented client Aqua Membranes in its $2.1M Series A-1 Financing round. Aqua Membranes is a unique technology that is perfect for spiral-wound membrane manufacturers eager to improve their product performance and whose customers demand more durable, low maintenance elements that can withstand challenging feed streams.

For the full press release regarding the Aqua Membranes $2.1M Series A-1 Financing, click here.

SA&M Attorneys Advising Aqua Membranes in this transaction included:

Caroline Cherkassky: Caroline Cherkassky is a Partner of the firm. Caroline's practice focuses on advising venture capital firms, angel investors, and emerging growth, development stage, and middle-market companies on a variety of matters, including venture capital and other financings, employee compensation, securities laws compliance, technology transactions, mergers and acquisitions, stockholder agreements, equity incentive plans, corporate governance, and other general corporate matters. She regularly serves as outside general counsel to early-stage companies and also advises executives regarding employment and compensation matters. Caroline is a frequent speaker on fundraising essentials for emerging growth companies.

Scott Alderton: Scott Alderton is a Founding Partner of the Firm, Managing Partner, and a member of the Firm’s executive committee. Scott is also co-chair of the Firm’s Venture Capital and Emerging Growth practice group. Scott advises clients across a number of industries, including software, technology, digital media, interactive entertainment and video games, cyber security and life sciences. Scott’s practice focuses on advising early stage to middle-market technology and emerging growth companies in all aspects of capital formation, venture capital and finance, corporate and securities laws, mergers and acquisitions, high technology, intellectual property, licensing, interactive entertainment and video games, the internet, digital media, manufacturing and distribution of goods in commerce and commercial contracts. Scott also regularly advises senior executive officers with respect to employment, compensation and equity incentives. Scott is frequently referenced as one of the top “start-up” lawyers in Southern California, and with over thirty years of experience working with technology and emerging growth companies at all stages along their evolutionary path, is sought out for his business as well as legal advice. Scott is a frequent speaker on matters relating to technology, intellectual property, capital formation, capital raising transactions and emerging growth companies, and was formerly an adjunct professor of law at Loyola Law school, teaching securities regulation.

About Stubbs Alderton & Markiles’ Venture Capital & Emerging Growth Practice

As a result of the Firm’s deep roots in the emerging growth market, Stubbs Alderton & Markiles understands the unique practical business needs of early-stage and high-growth companies. The Firm typically acts as outside general counsel to its emerging growth clients, including participating in board-level discussions and serving as an extension of the management team. The Firm strives to understand its clients’ business and markets and give them senior-level attention, which enables the Firm to provide practical and cost-effective legal advice. Representing private companies as they seek funding from venture capital firms, angel investors or other investors has been a key component of the Firm’s practice. The Firm also represents and has extensive relationships with the most prominent venture capital firms and angel investor groups in Southern California. The Firm has extensive experience in advising on a wide range of financing structures, including seed and angel investor financings, venture capital investments, private equity and other institutional financings, bridge loans, and PIPE transactions for public companies. The Firm’s representation of cutting-edge companies and leading investors allows it to stay apprised of developing market trends and, where appropriate, to make introductions to investors and companies.